Integration of the fast payment system as a competitive advantage tool for financial organizations

Digitalization of financial processes is becoming an integral part of modern business, playing a key role in increasing efficiency and adapting companies to rapidly changing market conditions. Digital payments are an essential part of companies’ strategy, providing fast, convenient and secure ways to process transactions. In particular, the fast payment system (SBP), as one of the most effective technologies, is able to significantly improve the efficiency of various financial transactions. In this article, we will look at how the SBP Connect software package from Right line helps financial organizations improve process efficiency and improve customer service.

A few numbers

The Fast Payment System (SBP), launched in 2019, continues to gain popularity, significantly displacing traditional bank transfers. As of May 2025, 225 participating banks have already been connected to the Fast Payment System.

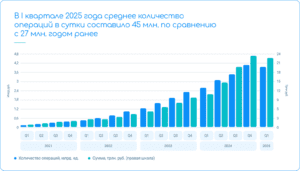

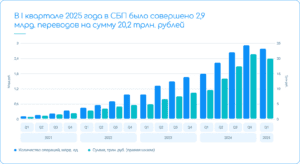

According to the Central Bank of Russia, according to the results of the first quarter of 2025, citizens conducted 4.1 billion transactions worth 22.6 trillion rubles through the SBP. Compared to the same period last year, the figures increased 1.6 and 2.1 times, respectively. Forecasts show that the volume of transactions through SBP will increase by another 35%, which confirms the growing popularity of this system among financial institutions and their clients.

According to the study, in the first quarter of 2025, 7 out of 10 Russians used transfers through the SBP, and 5 out of 10 made payments for goods and services. On average, each citizen made 29 transfers and 17 purchases through the SBP in the reporting quarter. The average transfer amount was 7 thousand rubles. At the same time, 4 out of 10 transfers are transfers between their accounts in different banks.

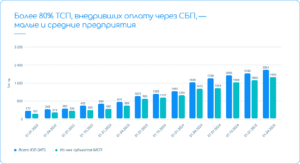

According to the Bank of Russia, the number of trade and service enterprises (TSPS) accepting payments through the SBP amounted to 2.4 million units. The number of SMEs in the SBP exceeded 1.9 million, which is 29% of the total number of SMEs.

The number and amount of transfers from legal entities to citizens (for example, insurance payments, payments from brokers, and others) increased by 1.4 and 2.3 times, respectively, compared with the same indicators of the previous year.

How does the fast payment system help financial institutions?

- Increasing the transfer rate

Unlike traditional bank transfers, which can take several days, transfers through the fast payment system take place in just a few seconds. This allows financial institutions to improve customer service by providing them with the ability to instantly transfer money between different banks and accounts. At the moment, more than 90% of transactions via the SBP are carried out in a few seconds.

2. Lower operating costs

SBP significantly reduces transaction costs, as fees for transfers through the fast payment system are much lower than for traditional transfer methods. The average commission for a transfer via the SBP is only 0.5% of the amount, which is two to three times lower than for traditional bank transfers. This gives financial institutions the opportunity to reduce payment processing costs and increase their profitability.

3. Increased safety and convenience

The system operates on the basis of highly efficient encryption technologies, which guarantees a high level of security for all users. In addition, customers can make payments using only a phone number, which makes the process simple and convenient for mobile payment users.

4. Improving the customer experience

Integration into the fast payment system provides customers with the ability to make transfers faster and easier. This is especially important for users who value their time and are looking for convenient ways to transfer funds. According to statistics, 72% of clients using SBP noted transparency, accessibility and speed of transfers, which also leads to an increase in the level of trust and loyalty.

5. Development of additional services

The introduction of SBP opens up new opportunities for financial organizations in terms of developing additional products and services, such as microcredit, automatic payments, and more. Thus, financial solutions for banks that include SBPs help strengthen their market positions and increase customer loyalty.

What is SBP Connect?

SBP Connect is a certified solution from Right line, designed to connect banks to the fast payment system. This innovative solution (included in the unified register of Russian software) provides banks with the opportunity to integrate all current scenarios for transferring funds through the SBP.:

- C2C – provides the payer with the opportunity to instantly transfer funds to the recipient’s account opened with a third-party bank

- Me2Me – provides the recipient with the opportunity to instantly transfer funds from their account at a third-party bank

- C2B – allows you to pay for goods and services by an individual to a legal entity

- B2C – accepting payments by a legal entity from individuals, as well as refunding funds in favor of individuals, working with registries

- B2B transfers between legal entities

- C2G – transfers for the provision of state and municipal services (taxes, fines, state duties)

- Cross-border transfers – transfers in favor of individuals located in other countries

- Cashback payments – instant payments when paying for goods and services through a Quick payment System

- Disputes – opening a dispute and refunding funds to the buyer’s account if he does not agree with the previously performed operation.

The solution enables financial institutions to make instant transfers between different banks in real time with minimal commission, which is certainly more profitable than traditional transfer methods.

SBP Connect Integration

SBP Connect can be easily integrated with various payment systems of the bank (with one or more at the same time) using expansion points. This allows financial institutions to provide diverse and flexible services to customers, helping them retain and attract new users.

The solution includes modules that interact with each other, providing high flexibility and scalability. Each module is prepared for horizontal scaling and is capable of operating in a fault-tolerant balanced cluster mode. The system can be deployed at multiple sites, ensuring uninterrupted operation around the clock, 7 days a week.

Today, SBP Connect is one of the key technologies for optimizing and improving digital payments of financial organizations. The implementation of the solution allows to increase the speed and security of transactions, reduce costs and improve customer service.

To learn how to connect the fast payment system and integrate SBP into your organization, just visit our Right line website at rtln.ru

Blog

The digital ruble in Russia: results of 2025, launch dates and requirements of the Bank of Russia

Biometric payment in retail: how banks and stores simplify the customer’s journey

Development of an online acquiring platform: architecture, payment gateway, Back Office and a turnkey merchant portal

Unified QR Standard: how the payment market is moving to a new infrastructure