The digital ruble in Russia: results of 2025, launch dates and requirements of the Bank of Russia

In 2025, the digital ruble project moved from a pilot to a large-scale implementation stage. The Bank of Russia has approved the deadlines for mandatory connection of banks and businesses, updated the regulatory framework and expanded the scenarios for using digital currency.

We analyzed the key results of the year, new market requirements and expectations for 2026. The material will be useful for banks, businesses and anyone who is preparing to work with the digital ruble.

The main changes over the past year

The key event for the digital ruble project in 2025 was the approval of a clear timetable for its large-scale implementation. The digital ruble has moved from the piloting stage to the stage of practical market preparation: the Bank of Russia has officially set the start date for mandatory connection — September 1, 2026. From this moment on, the introduction of the digital ruble into banks involves providing customers with a full set of basic operations, and for trading enterprises with annual revenues of more than 120 million rubles, the use of the digital ruble as a means of payment becomes mandatory.

For the rest of the market participants, the transition to the new digital currency of Russia will be gradual. Banks with a universal license and companies with revenues over 30 million rubles will be able to complete the adaptation of their systems by September 1, 2027, while small businesses and other banks will start working with the digital ruble on September 1, 2028. At the same time, the requirements for accepting the digital ruble in payment systems will not apply to retail outlets with annual revenue of less than 5 million rubles.

The established deadlines allowed the pilot participants to focus on optimizing internal processes and preparing solutions for the digital ruble for business, taking into account the practical test results.

During the year, work also continued on the regulatory and technological framework of the project. Two albums of electronic messages were released — the Album ES 2025.07 and the Album ES 2026.01, which was an important step towards unifying the interaction of the platform participants.

During the existence of the pilot project, its scale has grown significantly. The June report of the Bank of Russia on the progress of piloting provides the following indicators:

- About 2,500 wallets of individuals and legal entities are open on the digital ruble platform.;

- Transactions with the digital national currency are available to customers of 15 banks in more than 150 localities.;

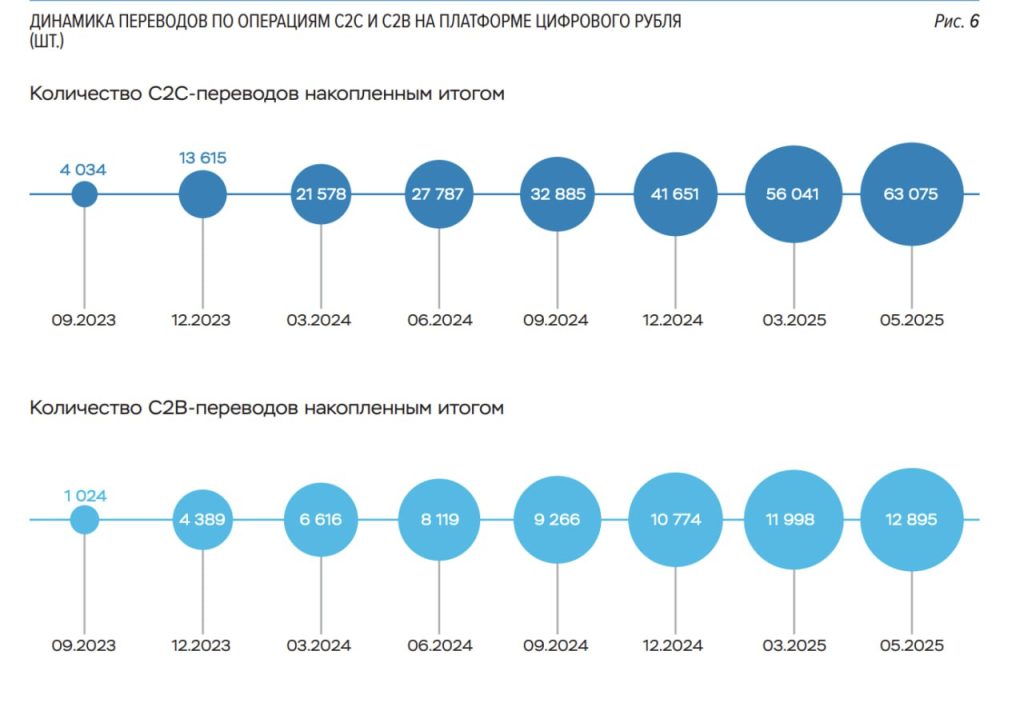

- over 63 thousand have been committed. C2C transfers and about 13 thousand C2B payments for goods and services, as well as more than 17 thousand smart contracts executed.

Compared to 2023, the volume of transactions has increased by more than 10 times, which clearly demonstrates the evolution of the project from a limited experiment to a full-fledged infrastructure of the future national payment system.

About Message albums

On July 1, 2025, a new album of electronic messages, version 2025.07, was put into commercial operation. It provided for the launch of six new scenarios, some of which were devoted to the implementation of anti-money laundering measures to ensure proper control over the legality of operations.

The main result of the implementation of the ES 2025.07 Album was the entry of the digital ruble into the contour of anti-money laundering legislation. Now, both commercial banks and the operator of the digital ruble platform, the Bank of Russia, will monitor transactions with digital rubles. The control functions are divided depending on how users will transfer orders on operations with digital rubles to the Payment processing Center — through the bank or directly to the operator.

As part of the implementation of the new scenarios, by 2026.01 Banks will be able to receive information on the current consents to which they are a party, as well as manage consents to transactions on behalf of clients-legal entities. Other new scenarios include a B2C refund with consent, a C2B transfer status request, and a consent information request from the Client.

Besides:

— new e-mails have been added in the scenarios “Replenishment of the Client-Legal Account” and “Replenishment of the Client-FL Account”.

— a long—awaited scenario has emerged – X2G, which has expanded the use of the digital ruble in the field of public services and treasury operations

It is important to note that the X2G script has been commercially available since 01.01.2026. Now, as part of the Pilot project, it will be possible to make payments to the budget in digital rubles, as announced by the Russian Treasury.

Other new scenarios for the ES 2026.01 album are planned for commercial operation in the second stage – by 02/28/2026.

What has changed for the Right line

After gaining access to the Central Bank’s support portal, we, along with other vendor colleagues, have direct access to up—to-date documentation and news from the Central Bank. We attend traditional meetings with developers of solutions for the digital ruble project, where we exchange our achievements, questions and suggestions with representatives of the Central Bank in an open dialogue.

Market reaction

According to our observations, banks’ interest in the digital ruble project in Russia is noticeably increasing as the regulatory milestones approach. During the year, we held a large number of working meetings: many credit institutions are at the stage of forming approaches, discussing target architecture and agreeing on concepts for implementing the digital ruble in banks, taking into account the requirements of the platform and internal IT landscapes.

In 2026, the digital ruble will become a zone of active practical implementation for our company. In the first nine months of last year, we managed to launch a pilot project with one of the largest banks, and three more initiatives are in the final stages of preparation. For a project of this scale, such dynamics demonstrate the market’s willingness to move from a theoretical discussion of the use of the digital ruble to its implementation in real banking and payment processes.

The role of the banks’ project teams should be noted separately: we always try to create the most comfortable conditions for productive joint work, which allows our joint efforts to achieve predictable results and move forward.

“Universal QR” within the Digital Ruble

The Central Bank has established that purchases will be paid for in digital rubles using the NSPK universal QR code. Banks must be technically ready to work with it by September 1, 2026. The terms of connecting the universal QR code to sellers will be determined by the Board of Directors of the Bank of Russia.

To date, the universal QR code is already available in retail outlets operating through the Fast Payment System (SBP). On the one hand, this is convenient for the client, since the payment scenario has practically not changed since the introduction of the possibility of paying in digital rubles, on the other hand, for banks, the volume of integrations will be insignificant. The NSPK will provide universal payment code services free of charge.

Terms of use of the digital ruble in 2026

The grace period is extended for legal entities: until December 31, 2026, they will not be charged a commission for transactions in digital rubles. As before, transactions with digital rubles remain free for individuals.

Starting from January 1, 2027, basic tariffs will apply to legal entities. In particular, when transferring digital rubles from individuals to legal entities (C2B transactions), the commission will be 0.3% of the transfer amount, but not more than 1.5 thousand rubles per operation.

In addition, at the end of last year, the Bank of Russia announced the introduction of zero fees for transactions from digital ruble accounts of individuals and legal entities in favor of the state. These tariffs will enter into force on January 1, 2026 and will be applied, among other things, to the payment of taxes and other mandatory payments.

Forecasts for the future

There is less than a year left before the start of mass adoption of the digital ruble for large banks, and 2025 is becoming crucial in terms of preparing for commercial operation. Those credit institutions that have not yet joined the pilot project will have to go from design to launch in a short time in order to meet the deadlines set by the regulator.

An additional factor will be the development of the regulatory and technological base. In April, the next Album of electronic messages is expected to be released, which will require banks to refine their systems and processes, but at the same time will allow them to unify and stabilize interaction on the digital ruble platform.

For businesses, the key effects are related to economics and automation. We are talking about reducing acquisition costs, simplifying calculations and the ability to build complex, multi-stage transactions using smart contracts, minimizing operational risks and manual labor.

For citizens, the digital ruble primarily means a familiar and understandable user experience: access to a digital wallet through banking applications, standard payment and transfer scenarios, and no fees. Together, this forms the basis for the digital ruble to stop being perceived as an experiment in 2026 and start working as a full-fledged, everyday payment instrument.

Blog

Biometric payment in retail: how banks and stores simplify the customer’s journey

Development of an online acquiring platform: architecture, payment gateway, Back Office and a turnkey merchant portal

Unified QR Standard: how the payment market is moving to a new infrastructure

Back office under pressure: how outdated software slows down banks – and what to do about it