ACS Right line

Solution for Issuing Banks and TPP

ACS Right line is certified in EMVCo, MIR, VISA, Mastercard and Union Pay International payment systems.

ACS (Access Control Server) is the issuer’s server responsible for interacting with the DS server of the payment system, with the issuer’s decision–making services and the cardholder. The development belongs to Wright Line LLC, which is the copyright holder of RID, and is listed in the Russian software registry (Registry entry No. 14752 dated 09/05/2022). ACS is one of the components of the 3-D Secure infrastructure.

The ACS solution is included in the registry of domestic software, and also has its own control panel with an intuitive interface and convenient settings for risk rules and black/white lists. To calculate the cost of the solution, you need to create an application on the website.

Solution

possibilities

Interaction with decision-making services of the issuing bank

Exchange of messages with the payment system server (DS)

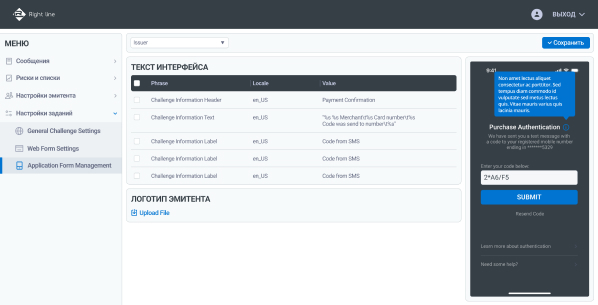

Interaction with the card owner in a Challenge scenario

Formation of a cryptogram (AV)

Advantages of ACS Right line solution

Supports 3DS v.1 (Visa/MS) and EMV 3DS v.2 (MIR)

Included in the unified register of Russian computer programs and databases

Possibility of horizontal scaling

ACS Right line solution is technologically compatible with PostgreSQL

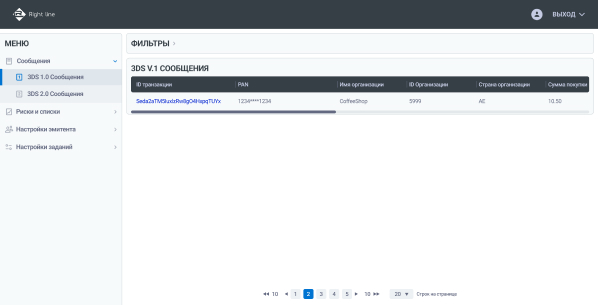

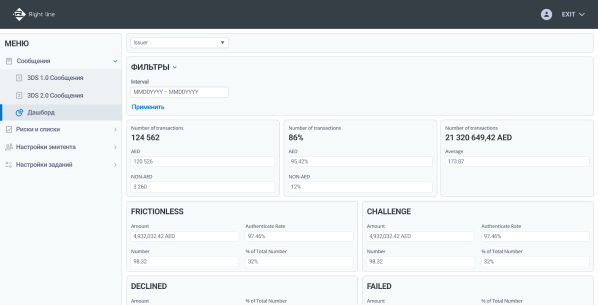

Convenient control panel for viewing 3DS messages

Characteristics of ACS Right line

Internal scoring

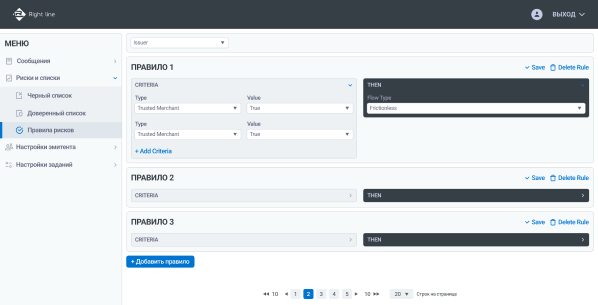

Has its own internal decision-making service capable of authentication through the Frictionless or Challenge script

Certification

Certified by NSPK and supports versions 1.0.2 (Visa, MS), 2.1.0 and 2.2.0 (Mir) of the 3-D Secure protocol. Has a certificate of technological compatibility with Postgres Pro Standard 13, 14, 15

On-us support

Supports the processing scheme for on-us transactions within the bank circuit, without using Directory Servers of payment systems

Integrations

Integrates with any internal bank systems (CRM, Mobile Bank, FMS, Notification Gate) and external systems (Mastercard Identity Check and others) for authentication

Scalability

Solution can work both as a single node and in balanced and managed cluster mode from several nodes 24/7

Safety

Ability to use multiple HSMs at the same time

Scoring

Has support for processing riscScoring SPR (NSPK) values, which allows you to increase the number of Frictionless authentications

Risk-based

authentication

The user authorization method is determined based on the risk assessment in the authentication request.

Three implementation options:

Built-in risk-based authentication (RBA) engine

Risk assessment is carried out based on the rules and parameters specified in the risk model

Risk assessment by an external system

The ACS transmits the data received in the authentication request to the external system and in response receives the client authentication method

Hybrid model

Uses an inbuilt RBA engine with calls to external systems to check individual risk rules

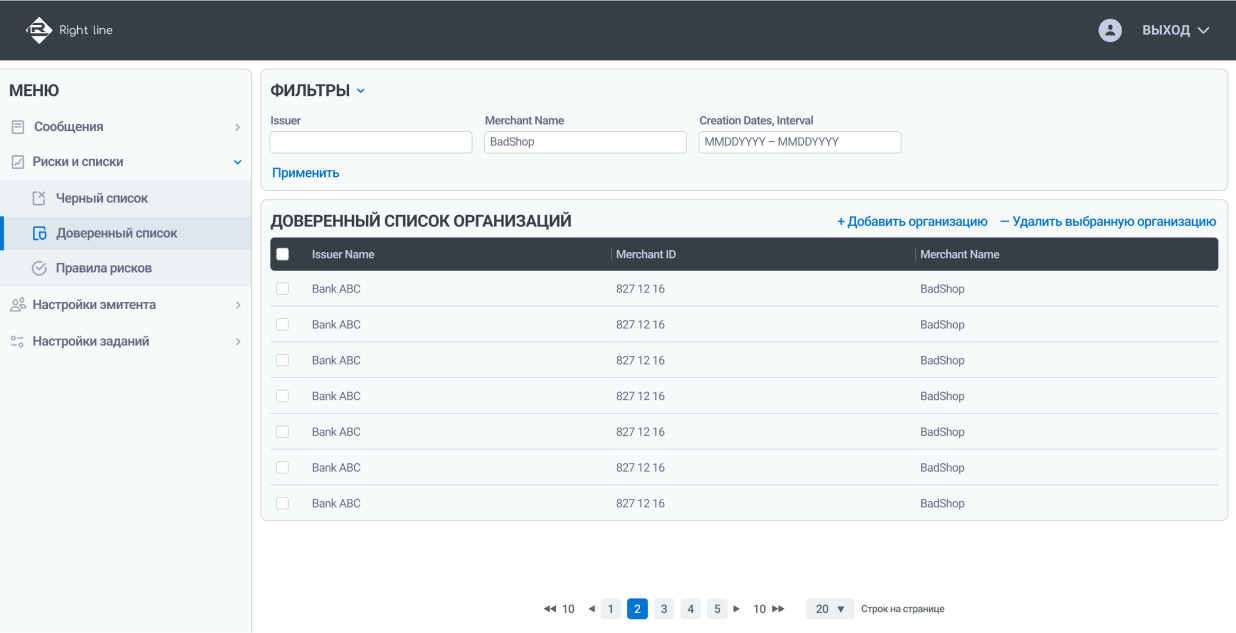

UI. Control panel

Functionality of the ACS Right line control panel